- Analysis of topical issues in public policy, financial markets, and the U.S. and global economies. Such projects often culminate in reports or presentations to the Bank’s president and senior management.

- Long-term academic research on a wide range of applied and theoretical topics. Many RAs have the opportunity to coauthor scholarly articles.

- Background in economics, mathematics, statistics, or a related field

- Experience in data analysis and using statistical packages (e.g., R, Stata, Matlab, Julia, SAS, Gauss, TSP, RATS, EViews, PROCSQL), or other computer programming experience (e.g., Java, C++, Python)

- Strong analytical and decision-making abilities and good communication skills

| POSITION | STARTING | DURATION | APPLICATION WINDOW |

| Research Analyst | Summer 2024 | 2 years | Sept. 6 - Oct. 1, 2023 |

| Summer Analyst—Junior (expected graduation in Dec 2024 or Spring 2025) |

June 2024 | 10 weeks | Aug. 31 - Nov.1, 2023 |

| Summer Analyst—Sophomore (expected graduation in Dec 2025 or Spring 2026) |

June 2024 | 8 weeks | Aug. 31 - Oct. 4, 2023 |

- Required: Upload Resume/CV and an academic transcript (from the institution you most recently attended/currently attend)

- Optional: Cover letter

- Note: Letters of recommendation will not be considered

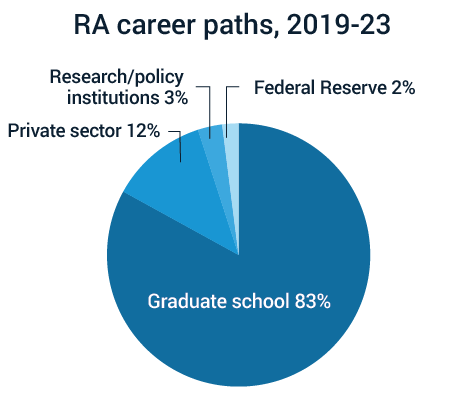

The majority of RAs enter graduate or professional degree programs after leaving the New York Fed. Many pursue a Ph.D. in economics or finance, with recent RAs joining programs in universities such as Berkeley, University of Chicago, Harvard, MIT, Princeton, Stanford, and Yale. Others go on to pursue degrees in business, law, and public policy from leading institutions.

New York Fed RAs also have a strong track record of obtaining fellowships: More than ten received fellowships from the National Science Foundation in 2020-23.

Fortune 500 companies and other top employers are seeking the skills and expertise you will gain as an RA. Former RAs have accepted positions at the Bank, while others have become leaders in the business, banking, higher-education, research, and nonprofit sectors.

An aspect of the Fed culture that I highly value is the emphasis on continuous learning, particularly within the Research group. The economists I worked with exemplified a genuine commitment to nurturing my development by involving me in all aspects of the research process, even during times it took longer to do so. They went out of their way to collaborate with me like a peer.

The support I received from my colleagues extended beyond my day-to-day responsibilities. When I was applying to graduate school, the economists went above and beyond to guide me in the process, which undoubtedly played a crucial role in my application results.

Outside of mentorship from economists, opportunities to expand my knowledge were abundant. Several times a week, I was able to attend seminars given by visiting scholars, which exposed me to a wide range of research areas. Thanks to the tuition assistance program, I took two fully funded graduate math courses in Probability and Measure Theory at NYU, which was both challenging and fun! I joined a committee on financial inclusion, where I contributed to a white paper on the disparate access to consumer financial products.

My time at the New York Fed has not only equipped me with a strong foundation in economic research, but has fueled my passion for learning and made a lasting impact on my career trajectory.

As an RA, I’ve been surprised by the many opportunities I’ve had to take the lead and generate ideas on research projects. Most of my work has focused on student loans—analyzing potential forgiveness plans and the effects of the pause on payments during the COVID-19 pandemic. On these projects, not only did I provide research analysis, but the economists actively encouraged me to contribute ideas and interpret results.

There were many times that I generated an idea for a specification or chart and was encouraged to see it through, and I’ve written large parts of research blogs and papers interpreting our results. I have been able to co-author multiple blogs on Liberty Street Economics and a research paper that’s currently under review at an academic journal.

Further, the economists encouraged me to generate and develop my own research ideas. With Daniel Mangrum, I worked on a project analyzing the impacts of legalizing sports betting on consumer credit. He worked with me to generate the idea and develop it—he provided guidance throughout and we hope to co-author an academic paper when the project is completed. All in all, I’ve been very grateful for the opportunities to contribute to research projects and gain valuable experience as I now head to graduate school in economics.

I loved my time as an intern at the New York Fed. My internship project was initially slated to be about recent changes in small business access to credit, with an eye toward the recent rise of “fintech” (financial technology) lenders. However, this topic was finalized in February of 2020….so plans quickly changed! I instead spent the summer of 2020 working on understanding the ins and outs of the Paycheck Protection Program (PPP)—a massive government credit program designed to help small businesses weather the storm without laying off their employees.

The experience and skills I developed over my ten weeks as an intern immediately helped me to become a better researcher—what questions were important? How could we use our data and analysis to convincingly answer them? The economists with whom I worked were instrumental in helping me along the way—I was consistently encouraged to provide my own views and opinions on our analysis of the data.

This dynamism—shifting gears to a totally different and extremely time-relevant project on short notice—really highlights why the NY Fed is such a unique and exciting place for someone new to research. When something as fundamental as the pandemic hits the global economy, Fed economists are equipped and encouraged to pursue real-time research that helps to inform policy design.

The RA cohort, and the Research Group more generally, have provided such a supportive and collegial environment for me to carry out my work and to acquire new skills. In addition to collaborating with RAs on my team on both policy and research projects, RAs from all over the floor have helped me with coding questions, cleaning unfamiliar data sets, and even course work for the Time Series Analysis course I took at CUNY Hunter while an RA.

The RAs encompass such a wide breadth of expertise in different coding languages, econometric techniques, and subject areas, so there is truly always someone to answer whatever question you might have. The same is certainly true for the economists. Although RAs mainly work with economists within their department, I’ve had the chance to build relationships with economists all over the floor, both through our formal mentorship program and simply because Fed economists tend to be very approachable and willing to discuss your research interests and your plans for the future. With the economists I’ve worked most closely with, I’ve enjoyed how interested they have been to hear my perspective on the projects we’ve worked on together.

The RA program allows me to learn how an economist approaches a question and to sharpen my research skills from coding (Stata, SQL, Python and so on) to time management. What truly sets the NY Fed program apart for me are exposure to policy projects and channels to learn from experts beyond my direct supervisors.

In my first year, for example, I worked with my economist supervisor Matteo Crosignani on a joint project with the Bank for International Settlements. We built on the CLASS framework—developed by my other supervisor Anna Kovner—and tried to gauge how rising interest rates could impact the largest U.S. banks. Experiences like this reinforce my interest to become a policy-minded financial researcher.

I also had abundant opportunities to learn from experts from within and outside of the Bank. Through the internal RA Mentoring Program, I paired up with Jason Somerville and Antoine Martin, two economists with distinct interests and in different divisions than mine. In addition, our seminar organizers almost always make sure to reserve time slots for all RAs to meet with speakers. I was also able to learn from external speakers and visiting scholars about how they navigate their career from entering graduate school to becoming an independent thinker.

Many of my RA peers went on to pursue paths other than an economics Ph.D. Several of them told me that they found the RA experience useful in clarifying how research in general would fit in their career. For example, in a typical policy project, an RA could be involved in a collaboration between the Research, the Markets and the Supervision Group—and the team members bring their unique research capabilities to the table, with or without a Ph.D.

Note: Research analysts' names are in bold.

Sergey Chernenko, Nathan Kaplan, Asani Sarkar, and David S. Scharfstein. “What Drove Racial Disparities in the Paycheck Protection Program?,” Liberty Street Economics, June 1.

Rajashri Chakrabarti, Dan Garcia, and Maxim Pinkovskiy. “Do Veterans Face Disparities in Higher Education, Health, and Housing?,” Liberty Street Economics, May 25.

Ozge Akinci, Gianluca Benigno, Marco Del Negro, Ethan Nourbash, and Albert Queralto. “Measuring the Financial Stability Real Interest Rate, r**,” Liberty Street Economics, May 24.

Gara Afonso, Marco Cipriani, Catherine Huang, and Gabriele La Spada. “Banks’ Balance-Sheet Costs and ON RRP Investment,” Liberty Street Economics, May 18.

Nina Boyarchenko, Richard Crump, Leonardo Elias, and Ignacio Lopez Gaffney. “Look Out for Outlook-at-Risk,” Liberty Street Economics, May 17.

Thomas Klitgaard and Ethan Nourbash. “Assessing the Outlook for Employment across Industries,” Liberty Street Economics, May 10.

Sergey Chernenko, Nathan Kaplan, Asani Sarkar, and David Scharfstein. “Applications or Approvals: What Drives Racial Disparities in the Paycheck Protection Program?,” Staff Reports, no. 1060, May.

Alena Kang-Landsberg, Stephan Luck, and Matthew Plosser. “Deposit Betas: Up, Up, and Away?,” Liberty Street Economics, April 11.

Gara Afonso, Marco Cipriani, Catherine Huang, Abduelwahab Hussein, and Gabriele La Spada. “Monetary Policy Transmission and the Size of the Money Market Fund Industry: An Update,” Liberty Street Economics, April 3.

Mary Amiti, Sebastian Heise, Giorgio Topa, and Julia Wu. “What Has Driven the Labor Force Participation Gap since February 2020?,” Liberty Street Economics, March 30.

Marco Del Negro, Aidan Gleich, Donggyu Lee, Ramya Nallamotu, and Sikata Sengupta. “The New York Fed DSGE Model Forecast—March 2023,” Liberty Street Economics, March 24.

Erica Bucchieri, Jacob Conway, Jack Glaser, and Matthew Plosser. “Does the CRA Increase Household Access to Credit?,” Liberty Street Economics, February 27.

Ozge Akinci, Gianluca Benigno, Hunter L. Clark, William Cross-Bermingham, and Ethan Nourbash. “How Much Can GSCPI Improvements Help Reduce Inflation?,” Liberty Street Economics, February 22.

Julian di Giovanni and Neel Lahiri, “How Much Can the Fed’s Tightening Contract Global Economic Activity?,” Liberty Street Economics, February 13.

Rajashri Chakrabarti, Dan Garcia, and Maxim Pinkovskiy. “Inflation Disparities by Race and Income Narrow,” Liberty Street Economics, January 18.

Beverly Hirtle and Sarah Zebar. “Bank Profits and Shareholder Payouts: The Repurchases Cycle,” Liberty Street Economics, January 9.

Jacob Goss, Daniel Mangrum, and Joelle W. Scally. “Assessing the Relative Progressivity of the Biden Administration’s Federal Student Loan Forgiveness Proposal,” Staff Reports, no. 1046, January.

Marco Del Negro, Aidan Gleich, Donggyu Lee, Ramya Nallamotu, and Sikata Sengupta. “The New York Fed DSGE Model Forecast—December 2022,” Liberty Street Economics, December 16.

Felix Aidala and Gizem Kosar. “SCE Labor Market Survey Shows Average Reservation Wage Continues Upward Trend,” Liberty Street Economics, December 19.

Alena Kang-Landsberg and Matthew Plosser. “How Do Deposit Rates Respond to Monetary Policy?,” Liberty Street Economics, November 21.

Michael Fleming and Claire Nelson. “How Liquid Has the Treasury Market Been in 2022?,” Liberty Street Economics,” November 15.

Linda S. Goldberg and Stone B. Kalisa. “Do Exchange Rates Fully Reflect Currency Pressures?,” Liberty Street Economics, November 10.

Rajashri Chakrabarti, Kasey Chatterji-Len, Daniel Garcia, and Maxim Pinkovskiy. “How Have Racial and Ethnic Earnings Gaps Changed after COVID-19?,” Liberty Street Economics, October 20.

David Dam, Davide Melcangi, Laura Pilossoph, and Aidan Toner-Rodgers. “What Have Workers Done with the Time Freed up by Commuting Less?,” Liberty Street Economics, October 18.

Adam Copeland, Catherine Huang, and Kailey Kraft. “With Abundant Reserves, Do Banks Adjust Reserve Balances to Accommodate Payment Flows?,” Liberty Street Economics, October 12.

Felix Aidala, Olivier Armantier, Fatima-Ezzahra Boumahdi, Gizem Kosar, Devon Lall, Jason Somerville, Giorgio Topa, and Wilbert van der Klaauw. “New SCE Charts Include a Measure of Longer-Term Inflation Expectations,” Liberty Street Economics, October 11.

Andrew Haughwout, Ben Hyman, Benjamin Lahey, and Jason Somerville. “Eviction Expectations in the Post-Pandemic Housing Market,” Liberty Street Economics, October 4.

Jacob Goss, Daniel Mangrum, and Joelle Scally. “Revisiting Federal Student Loan Forgiveness: An Update Based on the White House Plan,” Liberty Street Economics, September 27.

Daniel J. Lewis, Davide Melcangi, Laura Pilossoph, and Aidan Toner-Rodgers. “Approximating Grouped Fixed Effects Estimation via Fuzzy Clustering Regression,” Staff Reports, no. 1033, September.

Nathan Kaplan, Claire Kramer Mills, and Asani Sarkar. “Did Changes to the Paycheck Protection Program Improve Access for Underserved Firms?,” Liberty Street Economics, July 6.

Olivier Armantier, Fatima Boumahdi, Gizem Kosar, Jason Somerville, Giorgio Topa, Wilbert van der Klaauw, and John C. Williams. “What Do Consumers Think Will Happen to Inflation?,” Liberty Street Economics, May 26.

Fatima-Ezzahra Boumahdi, Leo Goldman, Andrew Haughwout, Ben Hyman, Haoyang Liu, and Jason Somerville. “Expected Home Price Increases Accelerate over the Short Term but Remain Stable over the Medium Term,” Liberty Street Economics, April 18.

Daniel J. Lewis, Davide Melcangi, Laura Pilossoph, and Aidan Toner-Rodgers. “Approximating Grouped Fixed Effects Estimation via Fuzzy Clustering Regression,” Journal of Applied Econometrics, forthcoming.

Marco Del Negro, Marc P. Giannoni, and Christina Patterson. 2023. “The Forward Guidance Puzzle,” Journal of Political Economy Macroeconomics 1, no. 1 (March): 43–79.

Michael Fleming, Giang Nguyen, and Francisco Ruela. 2023. “Tick Size, Competition for Liquidity Provision, and Price Discovery: Evidence from the U.S. Treasury Market,” Management Science (January).

Kenechukwu Anadu, Ryan M. Craver, and Gabriele La Spada. 2022. “The Money Market Mutual Fund Liquidity Facility,” Economic Policy Review 28, no. 1 (June).

Nicola Cetorelli, Michael Jacobides, and Sam Stern. 2021. “Mapping a Sector's Scope Transformation and the Value of Following the Evolving Core,” Strategic Management Journal 42, no. 12 (December): 2294-2327.

Rajashri Chakrabarti and Max Livingston. 2021. “Tough Choices: New Jersey Schools during the Great Recession and Beyond.” Economic Policy Review 27, no. 1 (July).

Michael Cai, Marco Del Negro, Edward Herbst, Ethan Matlin, Reca Sarfati, and Frank Schorfheide. 2021. “Online Estimation of DSGE Models.” The Econometrics Journal 24, no.1 (January): C33-C58.

Linda Goldberg and April Meehl. 2020. “ Complexity in Large U.S. Banks.” Economic Policy Review 26, no. 2. (March).

Michael Cai, Marco Del Negro, Marc Giannoni, Abhi Gupta, Pearl Li, and Erica Moszkowski. 2019. “DSGE Forecasts of the Lost Recovery.” International Journal of Forecasting 35, no. 4 (October-December): 1770-89.

Jacob Adenbaum, Adam Copeland, and John J. Stevens. 2019. “Do Long-Haul Truckers Undervalue Future Fuel Savings?” Energy Economics 81 (June):1148-66.

Michael Abrahams, Tobias Adrian, Emanuel Moench and Rui Yu. 2016. “Decomposing Real and Nominal Yield Curves.” Journal of Monetary Economics 84 (December): 182-200.

Meta Brown, John Grigsby, Wilbert van der Klaauw, Jaya Wen, and Basit Zafar. 2016. “Financial Education and the Debt Behavior of the Young,” The Review of Financial Studies 29, no. 9 (September): 2490-522.

Brandyn Bok, Daniele Caratelli, Domenico Giannone, Argia Sbordone, and Andrea Tambalotti. 2018. “Macroeconomic Nowcasting and Forecasting with Big Data,” Annual Review of Economics, 10, no. 1 (August): 615-43.

Joshua Abel, Robert Rich, Joseph Song, and Joseph Tracy. 2016. “The Measurement and Behavior of Uncertainty: Evidence from the ECB Survey of Professional Forecasters,” Journal of Applied Econometrics 31, no. 3 (April-May): 533-50.

Directions

E-mail us

Financial Intermediation Policy Research

- Banking Studies

- Climate Risk Studies

- Non-Bank Financial Institution Studies

- Capital Markets Studies

- Macrofinance Studies

- Money and Payments Studies

- Consumer Behavior Studies

- Equitable Growth Studies

- Urban and Regional Studies

- International Studies

- Labor and Product Market Studies

- Macroeconomic and Monetary Studies

More about Research and Statistics

More about Benefits

The Tuition Assistance Program has enabled RAs to:

- Earn a master’s degree in statistics (Columbia University) while working at the Bank

- Participate in other degree and certificate programs (New York University and Columbia University)

- Take individual graduate-level classes such as stochastic calculus, probability, statistics, real analysis, linear regression models, time series regression, linear algebra, continuous-time finance, derivative securities, graph theory, and partial differential equations.

More about the Undergraduate Summer Analyst Program

Follow us @NYFedResearch for our economists’ latest research and policy analysis.

Follow us @NYFedResearch for our economists’ latest research and policy analysis.